Good morning VC enthusiasts. It’s Data Thursday again. From a $335M Uber consolidation in Türkiye to a $625M seed fund and a $5.3B AI valuation, today’s edition is about capital structure at every layer: M&A, fund formation, platform scale, and reputational risk in venture.

In today’s Data Thursday edition:

Uber to acquire Getir’s delivery business in Türkiye for $335M

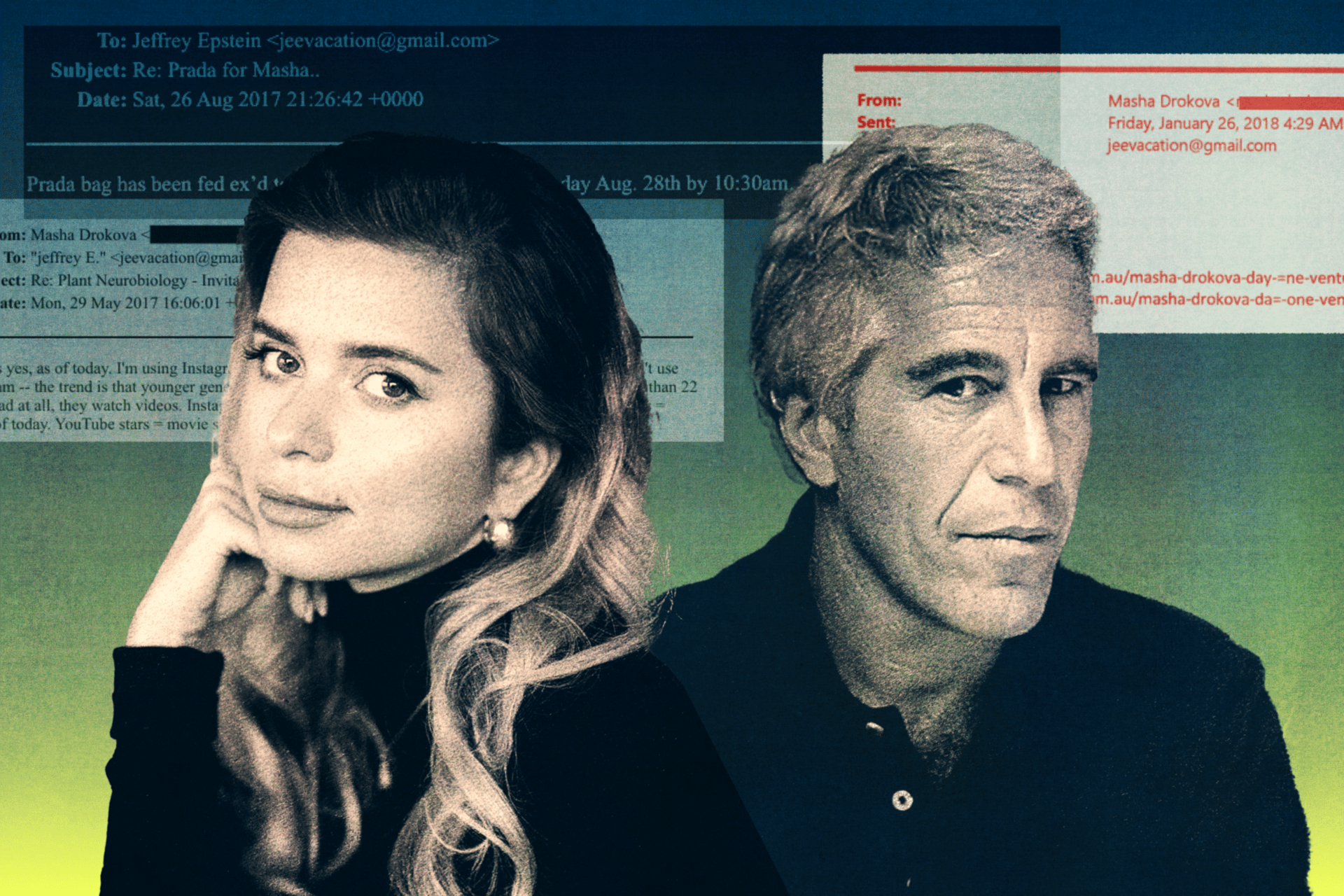

VC Masha Bucher responds after appearing 1,600+ times in Epstein document release

Spotify hits a record 751M monthly users

Primary Ventures raised a $625M Fund V

Career Corner & Free Data

PRESENTED BY THE RUNDOWN AI

How 2M+ Professionals Stay Ahead on AI

AI is moving fast and most people are falling behind.

The Rundown AI is a free newsletter that keeps you ahead of the curve.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses — tailored to your needs.

TOP STORY

The Inside: Uber will acquire Getir’s food delivery business in Türkiye for $335M in cash and invest an additional $100M for a 15% stake in its grocery, retail, and water delivery operations, deepening its bet on the Turkish market after last year’s $700M Trendyol Go deal.

The details:

Uber is buying 100% of Getir’s food delivery unit on a cash-free, debt-free basis, with closing targeted for H2 2026 pending regulatory approvals.

It will invest $100M for a minority stake in Getir’s remaining operations, with a path to acquire those assets over time if performance targets are met.

If completed, Uber would control both Getir and Trendyol Go delivery operations in Türkiye, integrating restaurant and grocery offerings across apps.

Getir previously acquired Germany’s Gorillas in a roughly $1.2B deal in 2022 during the quick-commerce boom, but later exited several European markets as the model struggled with profitability and capital intensity.

Why it matters: This marks another consolidation move in quick commerce after the 2021–2022 funding surge. Uber is effectively doubling down on Türkiye while Getir retrenches to its core market after an aggressive and ultimately costly European expansion.

FREE RESOURCES

🎓 Highlights: Data, Tools & MORE!

Break Into Venture Capital Guide: ACCESS THE NOTION

The Top 130+ German VC Funds: FULL LIST

The Top 90+ Indian VC Funds: FULL LIST

The Ultimate VC Tool Stack By Data Driven VC: READ HERE

The Inside/VC Beginner’s Knowledge Database: ACCESS HERE

Top 10 New VC Funds Launched Last Month: VIEW ON LINKEDIN

100+ Tech Unicorns That Got Minted in 2025: FULL LIST

How to get into a16z’s Speedrun startup accelerator program: READ HERE

EPSTEIN & VENTURE CAPITAL

The Inside: Masha Bucher, founder of Day One Ventures, publicly addressed her past relationship with Jeffrey Epstein after newly released documents referenced her name more than 1,600 times. The records detail her professional engagement with Epstein in 2017, including efforts to help rehabilitate his public image following his prior conviction.

The details:

Bucher acknowledged working with Epstein as a publicist after his 2008 conviction, stating she believed his version of events at the time and described herself as “naive.”

Emails cited in reporting indicate correspondence continued until 11 days before Epstein’s arrest in July 2019.

Documents reportedly show Epstein provided financial support during the early stages of Day One Ventures, along with personal gifts. There is no indication in the reporting that Bucher violated laws.

Day One Ventures has since grown to approximately $450M in assets under management, closing a $150M third fund in 2024.

In her public statement, Bucher said she has since denounced Vladimir Putin, relinquished her Russian passport, and met with some of Epstein’s victims.

Why it matters: In venture, reputation compounds alongside capital. While no legal wrongdoing has been alleged, historical associations can resurface and influence LP perception, founder trust, and co-investor dynamics. In a tighter fundraising environment, governance and optics increasingly sit next to returns in shaping who receives allocation.

PRESENTED BY DEEL

Global HR shouldn't require five tools per country

Your company going global shouldn’t mean endless headaches. Deel’s free guide shows you how to unify payroll, onboarding, and compliance across every country you operate in. No more juggling separate systems for the US, Europe, and APAC. No more Slack messages filling gaps. Just one consolidated approach that scales.

SHORTS

Cash App introduced payment links that let users request money via a simple URL that can be dropped into texts, emails, or DMs, preloading the requested amount for faster checkout.

The feature supports recurring and group payments and was designed after surveying Gen Z users who said in app requests can feel overly formal, with Cash App positioning links as a more flexible and socially natural way to get paid.

Spotify just reached a record 751M monthly active users in Q4, adding 38M new users in the quarter, with paying subscribers up 10% year over year to 290M.

Revenue rose 7% to €4.53B, gross margin improved to a record 33.1%, and the annual Wrapped campaign drove over 300M engaged users and 630M social shares, even as ad-supported revenue dipped 4% to €518M.

FUNDRAISING

Everything else in fundraising today

Primary Ventures raised a $625M Fund V to double down on seed investing nationwide, planning to write $5M–$10M checks into 40–50 companies as early-stage round sizes continue to expand in the AI cycle.

MrBeast’s Beast Industries acquired Gen Z-focused banking app Step, which has raised ~$500M to date and grown to 7M+ users, adding a scaled fintech product to its expanding consumer portfolio beyond media and CPG.

Runway raised a $315M Series E at a $5.3B valuation led by General Atlantic, nearly doubling its valuation as it pushes into “world models,” expands beyond media into gaming and robotics, and scales compute through a CoreWeave partnership.

Entire, founded by former GitHub CEO Thomas Dohmke, raised a record $60M seed at a $300M valuation led by Felicis to build open source tools that help developers manage and audit code generated by AI agents.

Inertia Enterprises, co-founded by Twilio’s Jeff Lawson, raised a $450M Series A led by Bessemer and GV to commercialize laser-based fusion technology pioneered at the National Ignition Facility, aiming to build a grid-scale plant by 2030 using 1,000 high-frequency lasers per reactor.

Career Corner: Hot Junior VC Roles

🇺🇸 Novo Holding - Intern VC Investments (Boston, MA) (LINK)

🇺🇸 NAVER U.Hub - VC Intern (Redwood City, CA) (LINK)

🇺🇸 Pear VC - Product Intern (New York City) (LINK)

🇺🇸 Cerity Partners Ventures - VC Intern (New York City) (LINK)

🇺🇸 SAV (Scale Asia Ventures) - VC Investment Intern (Palo Alto) (LINK)

🇫🇷 Sowefund - VC Analyst Intern (Paris) (LINK)

🇫🇷 SISTAFUND - VC Analyst Intern (Paris) (LINK)

🇫🇷 Air Liquide - VC Ops Intern (Paris) (LINK)

🇫🇷 XAnge - VC Analyst Intern (Paris) (LINK)

🇩🇪 Earlybird Venture Capital - Visiting Analyst (London/Berlin/Munich) (LINK)

🇩🇪 Simon Capital - VC Intern (Düsseldorf) (LINK)

🇩🇪 Alstin Capital - Visiting VC Analyst (Munich) (LINK)

🇩🇪 Brose Group - CVC Intern (Berlin) (LINK)

🇸🇬 GetSolar - VC Investment Analyst Intern (Singapore) (LINK)

🇳🇱 Natural Ventures - Intern Venture Capital (The Hague) (LINK)

That's it for today!

See you soon,

Jannis & Felix — the humans behind Inside/VC