Good morning VC enthusiasts. It’s Data Thursday again. We curated the most relevant new data points for VCs, product moves, and funding news, plus fresh VC roles and a special look at the Inside/VC investor tool stack. Let’s jump in:

In today’s Data Thursday edition:

LEAKED: What a16z’s fund data actually shows

Data, Tools & more

The Inside/VC Investor Tool Stack

Threads starts monetizing at scale

Career Corner: Hot Junior VC Roles

ANDREESSEN HOROWITZ

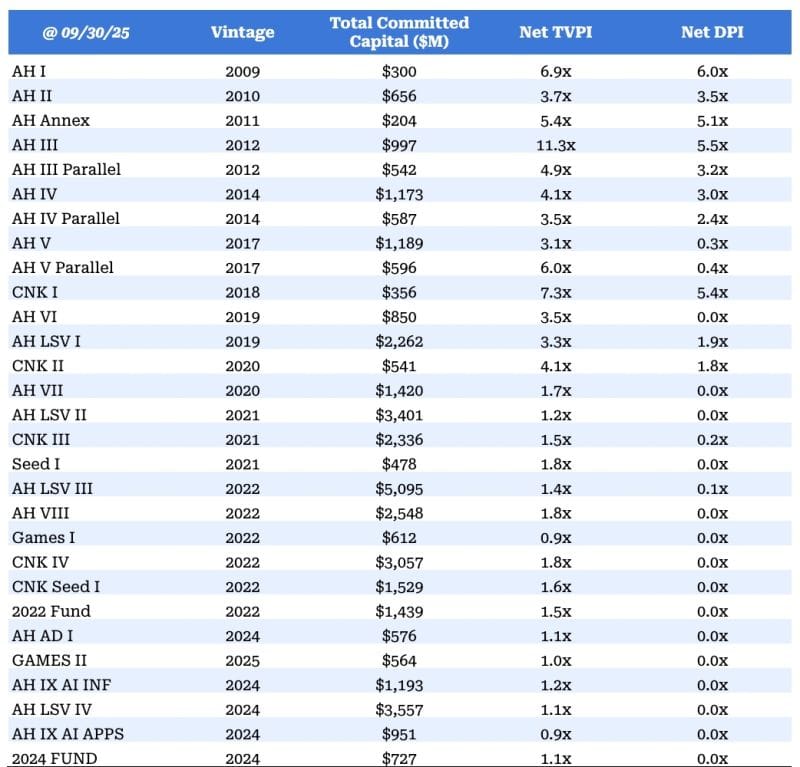

The Inside: Andreessen Horowitz has released official performance data across its fund vintages, offering a rare, clean look at how the firm’s strategy has evolved and where returns have actually been generated.

What the data shows:

2009–2014 vintages were exceptional.

Funds I–IV delivered strong, consistent returns with Net TVPI up to ~11x, driven by low entry prices and a traditional venture setup. These funds created the track record that enabled a16z’s massive scale-up later on.2017–2020 funds look solid.

Most sit in the ~3x–7x TVPI range, with Crypto I already returning meaningful DPI. This period marks the transition into larger growth and parallel funds with decent but less explosive outcomes.2021+ funds are early and follow a normal J-curve.

TVPI around ~1x–2x at this stage is expected due to fees, recent deployment, and limited realizations. Low DPI here is not a red flag yet, but reflects timing rather than outcomes.

Why it matters: The data shows a clear shift in strategy and scale. Early a16z funds generated outsized returns in a different market regime. Newer funds are structurally larger and will need more time and exits to prove whether the post-2019 model can match earlier economics.

FREE RESOURCES

🎓 Highlights: Data, Tools & MORE!

The Top 80+ French VC Funds: FULL LIST

The Top 45+ African VC Funds: FULL LIST

Break Into Venture Capital Guide: ACCESS THE NOTION

55+ AI startups that raised $100M or more in 2025: VIEW HERE

The VC Starter Pack (Top 10 Free Ressources): READ HERE

The Inside/VC Beginner’s Knowledge Database: ACCESS HERE

Top 10 New VC Funds Launched Last Month: VIEW ON LINKEDIN

Top 100+ Climate VCs In The US: FULL LIST

The 2015 Shopify Pitch Deck:

PRESENTED BY US

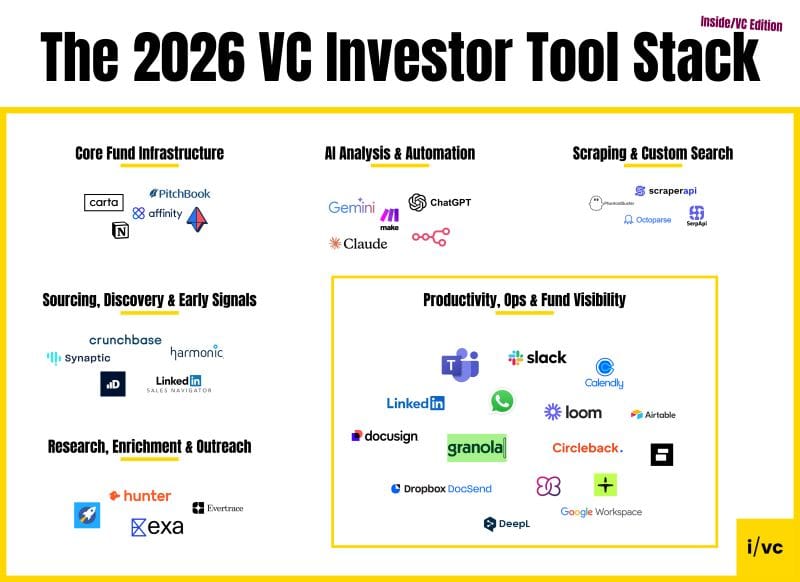

The Inside: We put together our 2026 VC Investor Tool Stack at Inside/VC after reviewing dozens of real world setups and comparing them to how VC work actually flows week to week.

The details:

Full workflow coverage, from fund infrastructure and CRM hygiene to sourcing, research, execution, and fund ops

Multi signal sourcing to spot companies before rounds are visible

Research and enrichment tools to build fast context instead of manual work

Scraping and custom search to cover gaps no database solves

AI layered on top to compress repetitive work and support pattern recognition

Productivity and visibility tools that act as the operating system of the fund

Why we build it?: The goal is not to show off tools, but to show how a coherent system looks when sourcing, research, execution, and fund operations are actually connected.

Download the full list here

META

The Inside: Just days after OpenAI announced ads in ChatGPT, Meta is now rolling out ads on Threads to all users worldwide, turning its fastest growing social app into a global monetization surface.

The details:

Threads has grown to over 400M monthly active users since its launch in mid 2023.

Ads will be rolled out gradually starting next week, with delivery kept intentionally low at first.

Meta allows advertisers to place Threads ads through existing Facebook and Instagram campaigns via Advantage+.

Supported formats include image, video, carousel, and 4:5 vertical placements.

Brand safety and third party verification tools from Meta’s partner ecosystem are enabled from day one.

Why it matters: Threads has scaled to 400M monthly users but has not generated meaningful revenue so far. Running a global social platform at this size creates real infrastructure and data center costs. Rolling out ads is not optional anymore, it is the only way to justify continued investment and keep Threads economically viable inside Meta’s broader platform stack.

SHORTS

Everything else in VC today

Ethernovia raised a $90M Series B led by Maverick Silicon to scale its Ethernet based processors for autonomous vehicles and robotics, as investor capital increasingly shifts toward infrastructure powering so called physical AI.

Everstone Capital combines Wingify and ABTasty to form a $100M+ digital experience optimization platform with over $100M in annual revenue, serving 4,000+ customers globally as consolidation accelerates across AI driven marketing and product software.

OpenEvidence raised a $250M Series D at a $12B valuation led by Thrive Capital and DST Global, doubling its valuation in three months as its ad supported platform crossed $100M in revenue and served 18M clinician searches in December alone.

India recorded 25.5B app downloads in 2025 and 1.23T hours spent in apps, driven by explosive growth in AI assistants like ChatGPT and Google Gemini, alongside a surge in microdrama apps that overtook OTT downloads in the second half of the year.

Career Corner: Hot Junior VC Roles

🇬🇧 Pi Labs - Intern Investment Team (London) (LINK)

🇬🇧 Paladin Capital Group - VC Intern (London) (LINK)

🇩🇪 D11Z. Ventures - Quantitative VC Intern (Munich) (LINK)

🇩🇪 UVC Partners - Junior VC Analyst Intern (Munich) (LINK)

🇳🇱 NLC Health Ventures - Visiting Analyst (Amsterdam) (LINK)

🇫🇷 Groupe SEB - VC Analyst Intern (Paris) (LINK)

🇫🇷 Air Liquide - VC Ops Intern (Paris) (LINK)

🇫🇷 Wind - VC Analyst Intern (Paris) (LINK)

🇩🇪 HTGF - VC Intern (Bonn) (LINK)

🇩🇪 Peec AI - Finance Intern (Berlin) (LINK)

That's it for today!

See you soon,

Jannis & Felix — the humans behind Inside/VC