Good morning VC enthusiasts. It’s Data Thursday again. Today we’re looking at a vibe coding startup claiming $100M ARR just eight months after launch, a $10B mega fund reshaping venture dynamics, and fresh capital flowing into AI infrastructure, chips, and power. Let’s jump in!

In today’s Data Thursday edition:

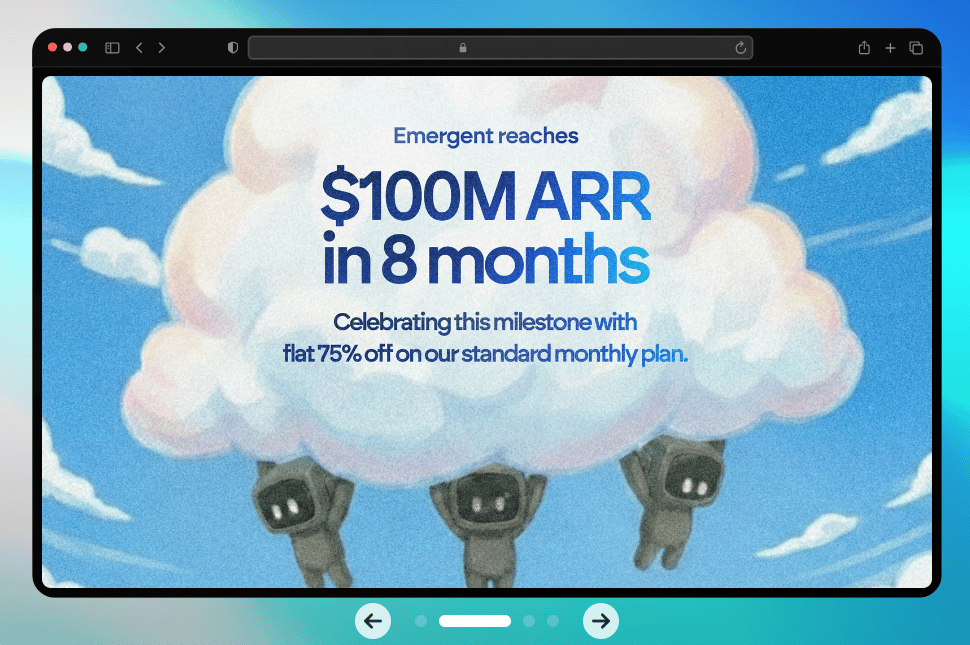

India’s Emergent claims $100M ARR just 8 months after launch

Data, Tools & more

VC Thrive raises $10B for its largest fund yet

Airbnb expands ‘Reserve Now, Pay Later’ globally

How Ricursive raised $335M at a $4B valuation in 4 months

PRESENTED BY WISPR FLOW

Write like a founder, faster

When the calendar is full, fast, clear comms matter. Wispr Flow lets founders dictate high-quality investor notes, hiring messages, and daily rundowns and get paste-ready writing instantly. It keeps your voice and the nuance you rely on for strategic messages while removing filler and cleaning punctuation. Save repeated snippets to scale consistent leadership communications. Works across Mac, Windows, and iPhone. Try Wispr Flow for founders.

VIBE CODING & ARR

The Inside: Emergent, a San Francisco and Bengaluru based vibe coding startup, says it has crossed $100M in ARR revenue just 8 months after launching, driven largely by small businesses and non technical users building production ready apps through AI prompts.

The details:

ARR reportedly doubled to $100M in the past month, with over 6M users across 190 countries and ~150,000 paying customers.

Users have created 7M+ applications, with 80 to 90% of new projects focused on mobile apps.

Roughly 40% of users are small businesses and about 70% have no prior coding experience.

Revenue comes from subscriptions, usage based pricing, and deployment and hosting fees, with improving gross margins.

The startup raised $70M in January led by SoftBank Vision Fund 2 and Khosla Ventures, tripling its valuation to $300M.

Why it matters: Vibe coding is quickly moving from hobbyist experimentation to real revenue infrastructure. If Emergent’s numbers hold, it suggests AI powered app building is unlocking a massive long tail of non technical founders and SMEs, compressing the path from idea to production and expanding the global software creator base far beyond traditional developers.

FREE RESOURCES

🎓 Highlights: Data, Tools & MORE!

500+ Tools VC Funds are Actually Using in 2026: VIEW HERE

Top 77+ Pre-Seed VCs Writing Checks: FULL LIST

17 AI companies that have raised $100M or more in 2026: FULL LIST

The Top 44+ Spanish VC Funds: AIRTABLE

a16z 40 ideas on what they want startups tackling in 2026: VIEW HERE

2026 European Venture & Startup Events: VIEW HERE

5 FREE Venture Capital Notion Templates: DOWNLOAD HERE

VENTURE CAPITAL

Thrive Capital has closed a $10 billion fund — its largest ever and nearly double the size of its previous vehicle — signaling continued LP appetite for big, diversified venture vehicles even as broader fundraising remains uneven. Of the total, $1 billion is earmarked for early-stage deals while the remainder targets growth-stage opportunities.

The details:

The new vehicle, Thrive X, is the firm’s 10th fund and was reportedly oversubscribed.

$1 billion is dedicated to early-stage investments; the rest is for growth stage.

Thrive’s portfolio includes high-profile names such as OpenAI, Stripe, SpaceX, Databricks, Anduril, and Cursor.

The firm has incubated 12 companies, of which six have become unicorns.

IPO speculation around OpenAI and SpaceX is cited as a factor driving LP enthusiasm and potential near-term distributions.

Why it matters: Mega-funds are consolidating capital at the top of the venture ecosystem while smaller and mid-tier funds find it harder to raise new vehicles. Funds under $500 million now make up a smaller share of total capital raised than they did five years ago, even as a handful of very large funds capture increasing allocations from limited partners. That dynamic risks concentrating power and LP commitments in a smaller set of managers and could squeeze the fundraising prospects for emerging and specialist funds in the current cycle.

SHORTS

Google introduced the $499 Pixel 10a with incremental hardware upgrades and expanded AI features, positioning it as a budget-friendly contender ahead of Apple’s expected $599 iPhone 17e launch.

The device features a 6.3-inch brighter display, 48MP main camera, Tensor G4 chip, Satellite SOS, and seven years of updates, while bringing AI tools like Auto Best Take and Camera Coach to the A-series, doubling down on AI differentiation in the sub-$500 segment.

Airbnb is rolling out its “Reserve Now, Pay Later” feature worldwide, allowing guests to secure eligible bookings without paying upfront and get charged closer to check-in, a move that drove 70% adoption among eligible U.S. bookings after last year’s domestic launch.

The company says the option has increased booking lead times and shifted demand toward larger homes, while only modestly raising cancellation rates, signaling that flexible payments are becoming a structural lever for boosting nights booked and average daily rates in a more price-sensitive travel market.

FUNDRAISING

Everything else in fundraising today

World Labs raised a $1B round, including a $200M strategic investment from Autodesk, to bring its world models into 3D design workflows, betting that spatial AI will become core infrastructure across media, architecture, and manufacturing rather than remain a standalone research tool.

Kana emerged from stealth with a $15M seed round led by Mayfield to build flexible, loosely coupled AI agents for marketers, as serial martech founders Tom Chavez and Vivek Vaidya bet that configurable, human-in-the-loop agents can outperform rigid legacy platforms across campaign planning, targeting, and optimization.

Heron Power raised $140M led by Andreessen Horowitz and Breakthrough Energy Ventures to scale solid-state transformers, as former Tesla exec Drew Baglino moves to meet 40+ gigawatts of data center and grid demand with semiconductor-based power hardware.

DG Matrix raised $60M in a Series A led by Engine Ventures to deploy its solid-state Interport systems, replacing bulky legacy transformers in data centers with more efficient, software-defined power infrastructure.

Ricursive Intelligence raised $300M at a $4B valuation just months after a $35M seed, as former Google Brain and Anthropic leaders Anna Goldie and Azalia Mirhoseini build AI systems that automate chip design for Nvidia, AMD, and other manufacturers, aiming to dramatically accelerate hardware innovation for the next wave of AI.

Career Corner: Hot Junior VC Roles

🇨🇦 Fengate Asset Management - VC Intern (Toronto) (LINK)

🇫🇷 Daphni - VC Analyst Intern (Paris) (LINK)

🇫🇷 Sowefund - VC Analyst Intern (Paris) (LINK)

🇫🇷 Air Liquide - VC Ops Intern (Paris) (LINK)

🇩🇪 b2venture - VC Internship (Berlin) (LINK)

🇩🇪 Alstin Capital - VC Internship (Munich) (LINK)

🇩🇪 Earlybird Venture Capital - Visiting Analyst (Berlin/Munich) (LINK)

🇺🇸 Novo Holding - Intern VC Investments (Boston, MA) (LINK)

🇺🇸 Naver Ventures - VC Intern (Redwood City, CA) (LINK)

🇺🇸 Pear VC - Product Intern (New York City) (LINK)

🇺🇸 Expansion VC - Finance Intern (Miami, FL) (LINK)

🇺🇸 Cerity Partners Ventures - VC Intern (New York City) (LINK)

🇸🇬 GetSolar - VC Investment Analyst Intern (Singapore) (LINK)

MORE NEWS:

The past few days have been packed, so we’ve added a few additional headlines worth your time below. If you want to go deeper, feel free to explore them as well.

That's it for today!

See you soon,

Jannis & Felix — the humans behind Inside/VC